These days, more homebuyers than ever before are turning to the internet when researching loan options. VA home loans stand out as one of the strongest loan products on the market for those with VA loan eligibility. Unfortunately, the web is also full of myths and inaccuracies that dissuade Veterans from using their VA loan benefits.

Let’s tackle the five most common VA home loan myths while also showcasing the advantages and flexibility of this unique financing tool.

Myth 1: VA Loans Require A Down Payment

Reality: VA loans require no down payment, but borrowers can choose to submit a down payment if they want. While no down payment is perhaps the cornerstone benefit of VA loans, a new Veterans United study found that only 3 in 10 Veterans know VA loans don’t require a down payment.

Placing a down payment can lower a borrower’s interest rate, monthly payments and create equity. If you are considering a VA loan and have cash reserves, you should consider spending a bit more to enjoy those benefits. With that being said, no VA loan borrowers are required to make a down payment.

Myth 2: The VA Acts As a Loan Lender

Reality: The Department of Veterans Affairs doesn’t actually loan out money. Instead, the VA provides lenders with a guaranty that promises to pay a certain dollar amount back if the borrower were to default on their loan. The VA also sets service eligibility criteria for Veterans, service members and surviving spouses, while lenders set financial criteria.

The VA guaranty is what allows the VA loan to have no required down payment. Lenders who finance VA loans understand they can expect a certain amount of money if the borrower defaults. The amount of money that the VA will repay on the borrower’s behalf is known as their VA loan entitlement, the exact value of which varies depending on several factors.

The VA loan guaranty and VA loan entitlement protects lenders and gives them more peace of mind. Along with these safeguards, borrowers have access to a wide range of other VA loan benefits, including no down payment, no PMI and closing cost limits.

Myth 3: VA Appraisals And Minimum Property Requirements Hinder Home Purchases

Reality: The VA appraisal is designed to be a safeguard, not a hindrance to VA loan borrowers. But, if you’re pursuing a home in poor condition, the VA appraisal can certainly slow you down.

Before a home purchase can be approved, VA appraisers follow the VA’s Minimum Property Requirements (MPRs) to determine if the home is safe, structurally sound and sanitary. Despite rumors on the internet, MPRs are not concerned with minor, nit-picky issues. Instead, MPRs include the following:

- Plumbing and electrical systems must be safe and in good condition

- Heating and cooling must be adequate

- Roofing must be stable and secure

- Loose paint must be scraped and repainted

- No leaks, excessive dampness, defective construction or decay

- No termites, destructive insects, fungus growth or dry rot

It’s clear from reviewing MPRs that VA loans are not designed to fund fixer-uppers. The VA wants to ensure the purchase of solid, move-in-ready homes, not suffering properties that could put VA loan borrowers and their families at risk. Choose a home in good condition, and the VA appraisal will be a breeze.

Myth 4: VA Loans Take Longer to Close

Reality: On average, it takes 40-50 days to close a VA loan, which is comparable to conventional and other standard loan types.

It’s true that the VA loan process may include more steps than a conventional loan, such as the VA appraisal and required repairs. When combined with other processes that all loan types undergo, such as underwriting and negotiations, it can seem like VA loans take longer.

You can avoid the majority of potential stumbling blocks with proper planning. By getting preapproved, finding an experienced real estate agent and VA loan lender and choosing a home in good condition, you should be well on your way to closing.

Myth 5: Real Estate Agents and Sellers Prefer Conventional Over VA Loans

Reality: There’s no way to predict which loan types real estate agents and sellers will prefer. Depending on housing market conditions and the state of the economy, different loan types may seem more favorable than others. Nevertheless, you shouldn’t forgo using your hard-earned VA loan benefits out of fear of the unknown.

On the internet, there are several anecdotes of VA loan borrowers who assume they lost out on a home deal because it didn’t meet MPRs, the appraisal of the home’s value came in lower than the asking price or the seller didn’t want to pay non-allowable fees. While these situations do occur, ultimately, the VA loan borrower is protected from a poor deal and often a problematic home.

Conversely, there are many stories of VA loan borrowers who received more preferential treatment because they found a home for sale by a Veteran. Veterans look out for each other, often preferring to sell their home to another military member, even if they have a higher offer from another interested party.

The VA loan terms of a home for sale can also be assumed by another eligible VA loan borrower. Even in challenging conditions, VA loan homebuyers can purchase a property with more favorable interest rates and monthly payments.

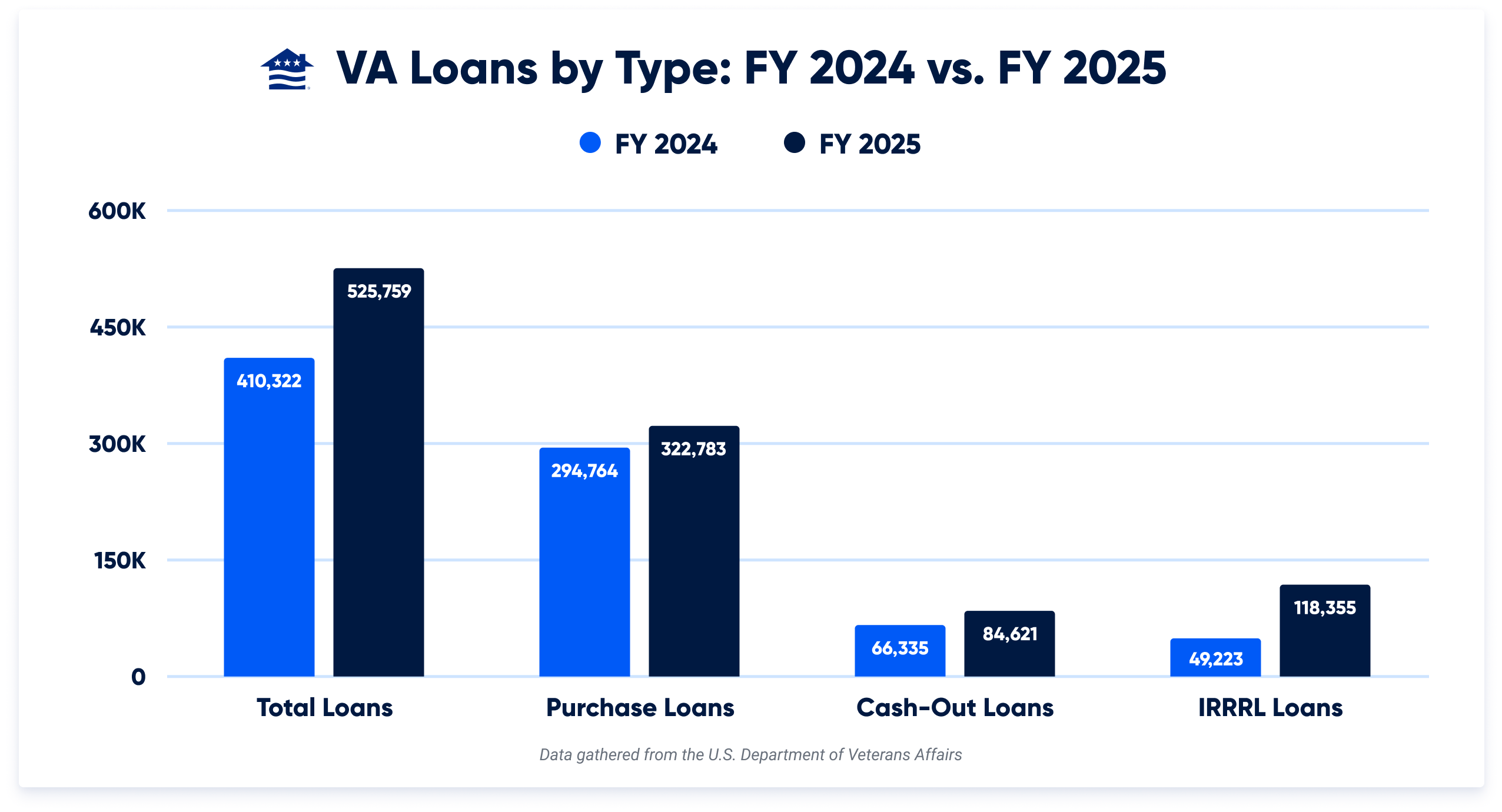

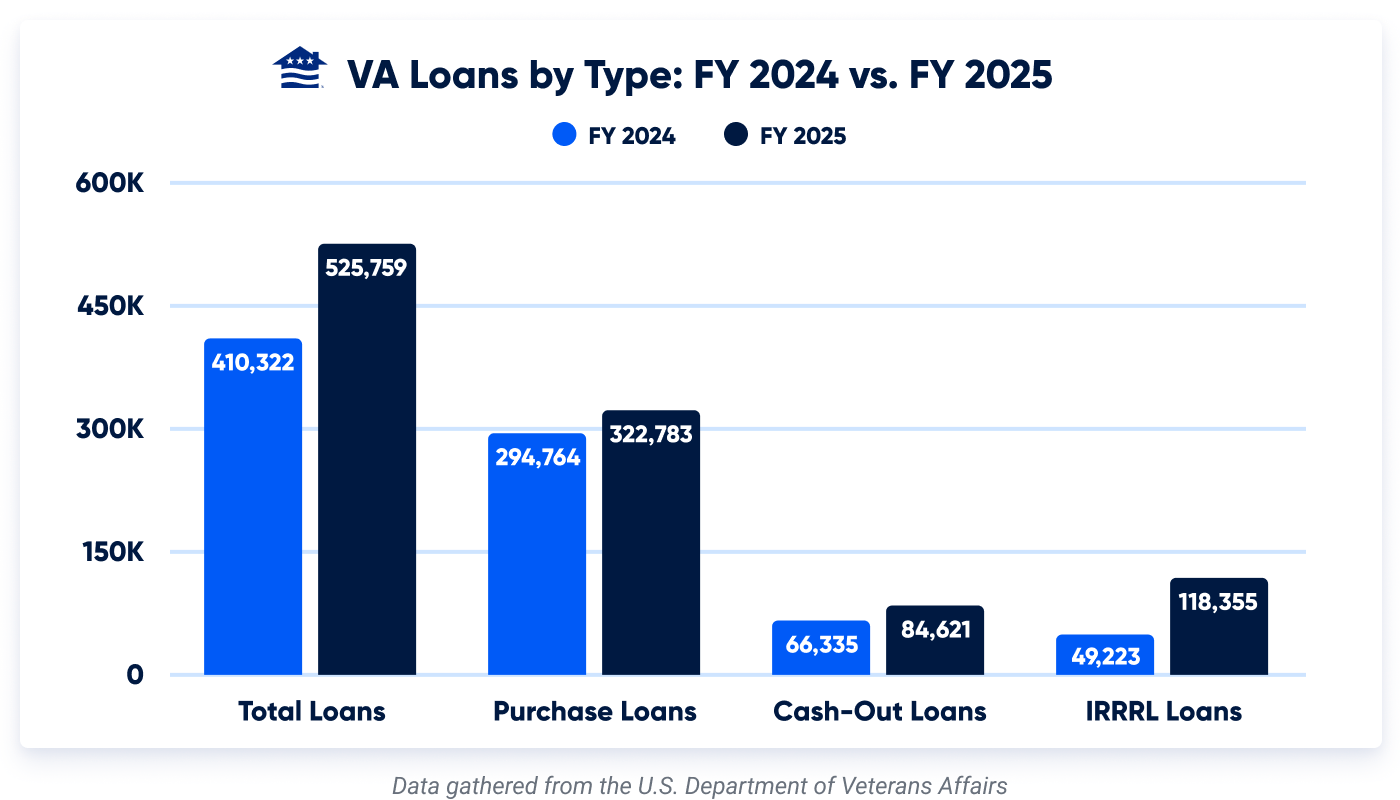

VA offers certainly aren’t rare. In FY 2025, Veterans and service members used VA loans more than 528,000 times, including about 323,800 home purchases. That’s an 8.5% jump in VA purchase loans compared to the previous year. Numbers like that show VA-backed offers aren’t an exception. They’re something sellers and agents work with all the time.

Ultimately, it’s important to work with a real estate agent who’s familiar with how VA loans work. Veterans United Realty (VUR) can match you with a licensed local agent who specializes in assisting Veterans and military families in locating and acquiring their ideal homes. A trusted VUR agent can inform the listing agent and seller about the VA loan homebuying process and dispel any myths or misconceptions they may have.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Jan 15, 2026

Written BySamantha Reeves

Added VA loan data for fiscal year 2024 and 2025 to demonstrate the growth and popularity of the VA loan.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

VA Loan Down Payment RequirementsVA loans have no down payment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements.

VA Loan Down Payment RequirementsVA loans have no down payment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements. -

VA Certificate of Eligibility (COE) and How to Get OneYour Certificate of Eligibility (COE) verifies you meet the military service requirements for a VA loan. However, not everyone knows there are multiple ways to obtain your COE – some easier than others.

VA Certificate of Eligibility (COE) and How to Get OneYour Certificate of Eligibility (COE) verifies you meet the military service requirements for a VA loan. However, not everyone knows there are multiple ways to obtain your COE – some easier than others.